Preparation of Qualified Annual Financial Statements in Accordance with Commercial Law and Tax Law

Preparing annual financial statements according to commercial law and tax law is among the more complex tasks in tax consulting. We have been specialized in annual financial statements since the company’s inception in 2006.

Balance Sheet, Profit and Loss Statement, Notes and Management Report – We Are Here to Help You

All business people are required to prepare annual financial statements according to commercial law. These are comprised of a balance sheet and profit and loss statement (P&L), at the absolute minimum. Additionally, GmbH & Co KGs and corporations such as GmbHs also have to prepare notes and consider further regulations, unless they fall under the facilitations for micro-entities. Starting at a specific size, a management report must also be prepared, and annual financial statements must be audited by an independent chartered accountant or a sworn accountant.

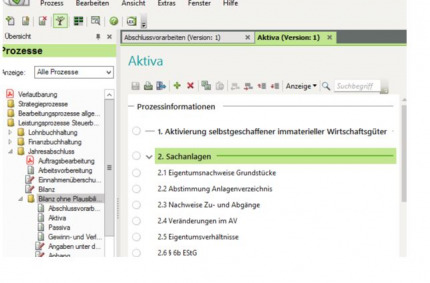

Annual financial statements prepared digitally

Annual Financial Statements as Criteria for Decision-Making

Annual financial statements are important criteria for decision-making, for example, when searching for investors or buyers for a company or when a bank grants loans. In addition, shareholders are kept informed of the commercial success of the company.

Due to varying regulations in regards to commercial law and tax law, a separate tax balance sheet must be prepared in many cases.

Preparation of Commercial Balance Sheets

The annual financial statements are based on the financial accounting. If the accounting is incomplete or contains mistakes, this often leads to incorrect annual financial statements and to complications with tax authorities, like in cases when the turnover does not match the submitted advance VAT returns. This often results in queries from the tax authorities or special VAT audits. If we notice mistakes in accounting, we will correct them in the annual financial statements. If the accounting is prepared by us, the work associated with annual financial statements will be less.

Requirements for Preparing Annual Financial Statements

We undertake the following tasks:

- Reconciliation of the opening balance with the closing balance of the previous year

- Critical review of financial accounting

- Review of cut-off of sales revenues and costs in the correct financial year

- Depreciation of fixed assets

- If necessary, value adjustments on accounts receivables

- If necessary, participation in taking inventory

- Support in valuation of inventories

- Provision calculation

- Tax calculation.

As chartered accountants, we prepare a report on the preperation of the annual financial statements, which you can present to your bank, other shareholders or tax authorities. Banks attach great importance to the fact that the annual financial statements have been prepared by a chartered accountant as the quality is often considered to be high.

Commercial Balance Sheets for Decisions and Distribution of Profits

Commercial balance sheets are required by law, but they are also especially useful for companies and their partners: On the one hand, these show investors how a company is doing and how it has grown and developed. While on the other hand, the commercial balance sheet is obviously an important statement on the business situation for the management. Professional decisions are made based on the commercial balance sheet, e.g. regarding investments and activities for marketing and expansion. And last but not the least, possible distribution of profits for shareholders is calculated on basis of the commercial balance sheet.

Tax Balance Sheet Preparation

The figures to be entered in the tax return are either derived from the commercial balance sheet or a separate tax balance sheet. Only the tax balance sheet is prepared according to the rules of the tax law and it is used to determine the basis for the tax calculation. This is also called the assessment basis. The main differences between commercial and tax balance sheets are listed here.

Too much information? As tax advisors, we know how quickly non-experts can get lost in these terms. You do not need to worry. We prepare tax balance sheets within the scope of qualified annual financial statements for our clients.

Cash basis accounting

Unless you are obligated to prepare annual financial statements, it is enough if you determine the profit as surplus of the operating revenues over the operating expenses. These are then compiled in a cash basis accounting. Further information can be found here.

We will gladly prepare the cash basis accounting for you and fill out the corresponding tax forms to be sent to the respective tax authorities.

Disclosure – Adhere to Deadlines or Pay High Penalties

Depending on their size and legal form, certain financial data must be disclosed or filed in order to avoid fines. Further details can be found here.